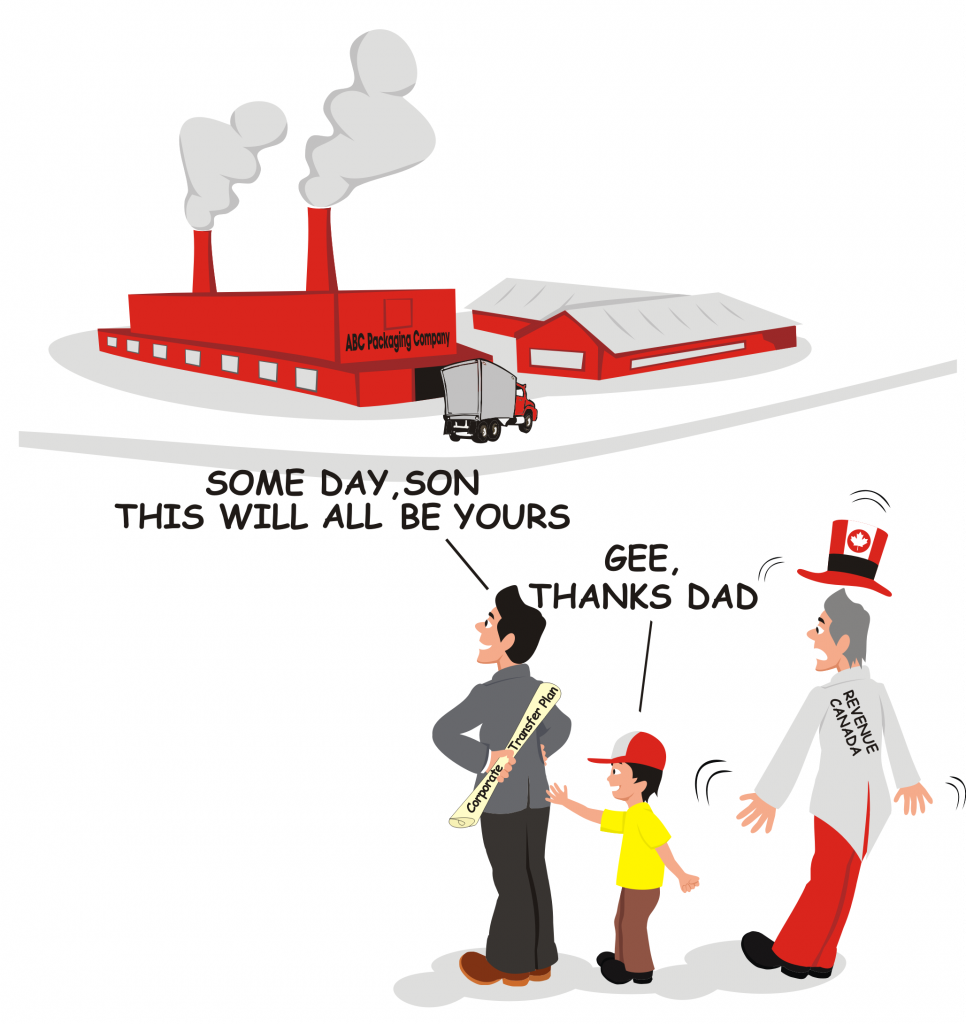

Harry age 72 and his wife Betty age 70, have worked hard all of their lives running a successful packaging company.

Last year they decided to retire and hand over the day-to-day operations of the business to their three children. They are enjoying their retirement and are generating sufficient income to maintain their lifestyle and cover medical expenses. Over the years they have accumulated just over 5 million dollars of surplus cash in one of their holding companies.

Since they don’t need all that money to live on, they eventually want to pass it on to their children in the most tax efficient manner.

The Challenge for Harry and Betty

Their surplus corporate investments are tied up in a taxable environment that increases their tax burden. Plus they realize that these investments will form part of their taxable estate value, so probate fees and other estate charges will decrease their value, leaving less for their children.

They would like to keep 2 million dollars in their holding company for emergency medical expenses, and give the remaining 3 million to their children. Their main concern is giving their children the highest amount of tax-free money possible from their company.

If Harry and Betty do nothing, then on their deaths their children will eventually receive the assets from the company and pay taxes somewhere in the range of 26% to 48% to get the money out.

Solution-Corporate Asset Transfer Plan

Working with an independent corporate insurance specialist, Harry and Betty decide to purchase a joint-last-to-die universal life insurance plan on both of their lives.

The insurance policy will be paid by the company, and the company will be named as both the owner and the beneficiary of the policy.

This allows them to transfer the money from a taxable environment to a non-taxable environment.

They decide to deposit a total of 3 million dollars, spread out over 6 years from their company into a corporate-owned tax-exempt universal life plan.

Annual Deposit

Year 1 $832,000

Year 2 $582,000

Year 3 $455,000

Year 4 $442,000

Year 5 $384,000

Year 6 $305,000

After the 6th year, no more deposits required and the policy is paid off.

(Note: spreading the payments out over 6 years allows Harry and Betty to stay within the Maximum Tax Accumulation Reserve (MTAR) line. MTAR simply means how much money Revenue Canada will allow an individual to tax-shelter and grow in a corporate-owned permanent insurance policy).

After they pass the medical exam required for the insurance policy, the amount of insurance coverage came out to $7 million and payable to the children on last death. The life insurance proceeds would be paid out to their holding company.

Subsequently, their company is then able to flow the insurance proceeds up the amount of the Capital Dividend Account (CDA) to their children tax-free. Any amount over the CDA balance will be subject to tax.

The Benefits

- Harry and Betty’s holding company investments are transferred from a taxable investment vehicle into a tax-deferred environment, reducing his company’s overall tax bill.

- The value of their estate is immediately increased by 4 million from the life insurance benefit.

- Upon the last death, the insurance proceeds are paid tax-free to their children through the company’s capital dividend account.

- Harry and Betty avoid costly probate and executor fees on the 4 million that is transferred to their children, preserving the value of their wealth.

Disclaimer

This example provides information of a general nature only. Always consult a professional for personal tax advice and any specific legal questions. This material is for information purposes only and should not be construed as providing legal or tax advice. Reasonable efforts have been made to ensure its accuracy, but errors and omissions are possible. All comments related to dividends, cash values, insurance amounts and taxation are general in nature and are based on current Canadian tax legislation which is subject to change.